Changes To Oregon PIP Insurance – New Law Coming in 2016!

In 2016, Oregon Personal Injury Protection (“PIP”) insurance will undergo several significant changes which will benefit Oregon drivers who are injured in serious auto or pedestrian accidents. The new law, Oregon Senate Bill 411, will take effect on January 1, 2016, and change the applicable timeframe to seek Oregon PIP insurance reimbursement and how/when economic and non-economic damages are reimbursed from PIP insurance. This is significant for some personal injury cases in that not all damages for medical bills and lost income have been incurred within the current defined time limits.

Extending the timeframe of Oregon PIP insurance benefits and delaying insurance company reimbursement will materially aid Oregon drivers obtain the resources they need to recover from serious accidents.

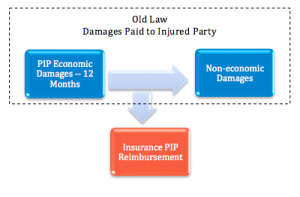

In addition, current laws provide for the reimbursement of PIP before non-economic are paid, effectively reducing the amounts paid to the injured person.

Key Changes to Oregon PIP Insurance Timeframe and Reimbursement Policy

What is PIP insurance?

Every driver in Oregon is required to carry Personal Injury Protection insurance, frequently called PIP, of at least $15,000 in medical coverage. This coverage is Oregon’s version of no-fault insurance. If you are injured in a car, pedestrian, or bicycle accident, then your PIP insurance will pay for your “medical bills”, regardless of who was at fault, for up to 12 months after the accident or up to $15,000, whichever occurs first. PIP insurance will also compensate you for 70% of your lost wages (capped at $3,000 per month) for up to 52 weeks if you miss more than two weeks of work due to your injuries. Currently, if you settle with the at-fault driver’s insurance company and receive compensation for your injuries, then you may have to reimburse your own insurance company out of your settlement for the PIP benefits it paid for you.In many circumstances, insurance companies are entitled to PIP reimbursement before their insured customer who was injured is entitled to receive “non-economic damages” for pain and suffering. Because the insurance company is “first in line” to be reimbursed before non-economic damages are paid, this unfairly reduces the money available to the injured person.

Timeframe for PIP Coverage Extended From 12 to 24 Months

Under current law, Oregon PIP insurance will pay for your medical expenses up to 12 months after the accident. For most minor collisions, this is an adequate timeframe to recover from your injuries. But, what if you sustained more severe bodily injuries that require multiple surgeries, or extensive rehabilitation that cannot be completed within the 12 month period?

The new law targets this problem by extending the allowable time period for Oregon PIP insurance coverage up to 24 months after the car accident.

Oregon PIP Insurance Reimbursement Delayed Until All Injured Party Damages Resolved

Under the new “PIP make whole” law, reimbursement of Oregon PIP insurance benefits to the insurance company thatpaid on the victim’sbehalf will be made only AFTER ALL of the economic and non-economic damages have been defined and paid. This change will insure that priority is placed on accident victim’s recovery and the ever increasing costs, and not insurance company reimbursement.

Actions You Must Take to Take Advantage of the New Law

While it may seem reasonable to expect insurance companies to automatically implement these changes on January 1, 2016, that is not the case. In order to take advantage of the changes in the law, you need to have your insurance company reissue your policy after January 1, otherwise the same exclusions will remain in the policy until you renew. It is critical that all Oregon drivers contact their insurance companies and request that all of their auto policies be renewed or reissued on January 1, 2016.

Mayor Law, Oregon Personal Injury Law Firm

If you or someone you know has been injured as a result of a car, pedestrian, or bicycle accident, and you are looking for a skilled attorney to lead you through insurance roadblocks and confusion, please call today for a free and confidential case evaluation. Local (503) 444-2825, Toll free 1-800-949-1481, or email travis@mayorlaw.com.

Additional Resources

For more information on Oregon PIP insurance and its impact on recovering from Oregon accidents visit the following resources:

Understanding Insurance and Personal Injury Claims FAQs

Free Legal Consultation with a Personal Injury Lawyer

UM/UIM Motorist Coverage: Is it Necessary?

9 Ways to Avoid Getting Duped by Insurance Company Settlement Tactics… And Recover For Your Injuries